Investment Market Review 2nd Qtr 2019

- By Gary Clark

- •

- 22 Aug, 2019

- •

From the financial crisis of 2008-2009 until the present:

· Out

of the ordinary investment market conditions

· The

level of risk we face in maintaining our standard of living during retirement

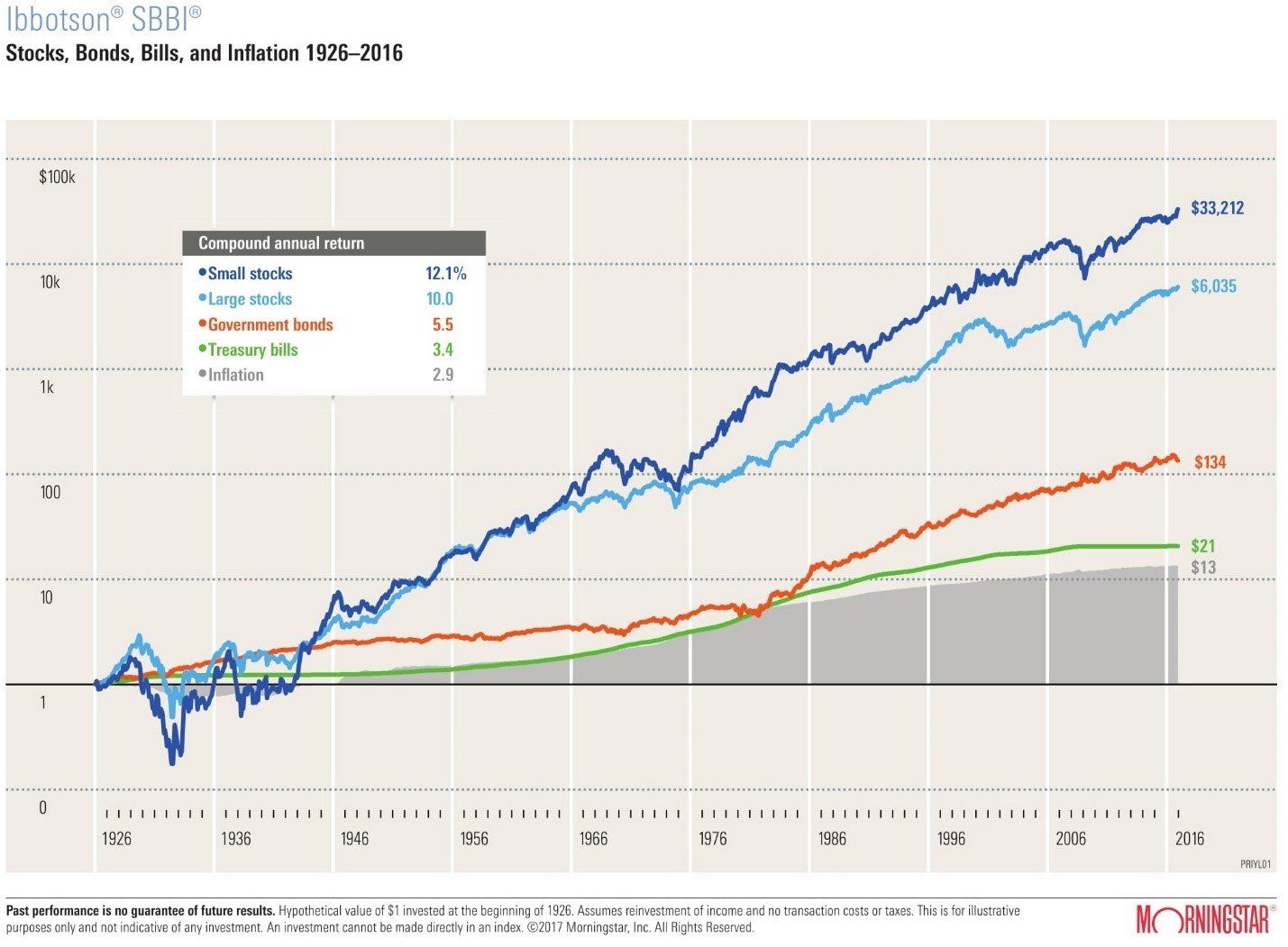

Approx. 40 Years of Tailwinds began

Resulting from:

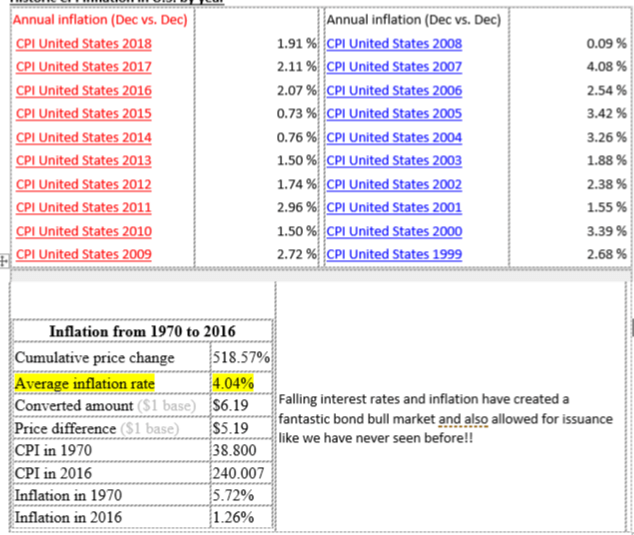

1. Falling inflation

2. Falling interest rates

3. Increased globalization

4. Deregulation

5. Shareholder-first capitalism

6. Baby boomers coming to peak earnings

7. Passive investing (indexing)

8. Extreme interventionist monetary policy, primarily Quantitative Easing (QE) and Zero Interest Rate Policy (ZIRP)

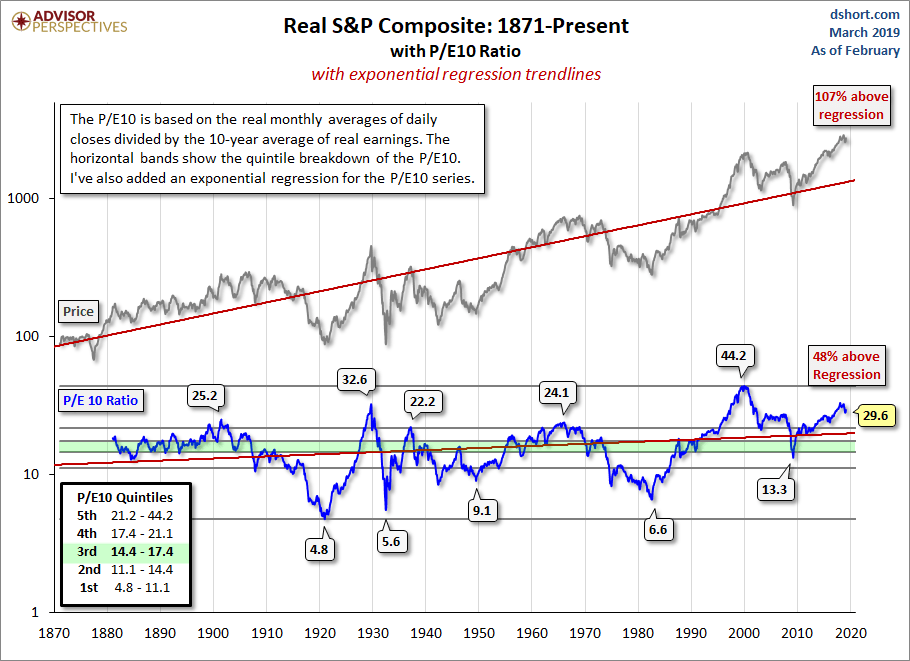

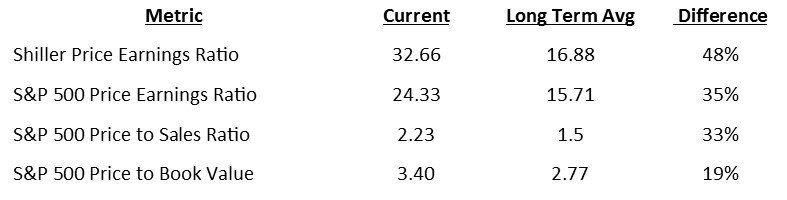

Resulting in: Financial Asset Overvaluations (bubbles)

|

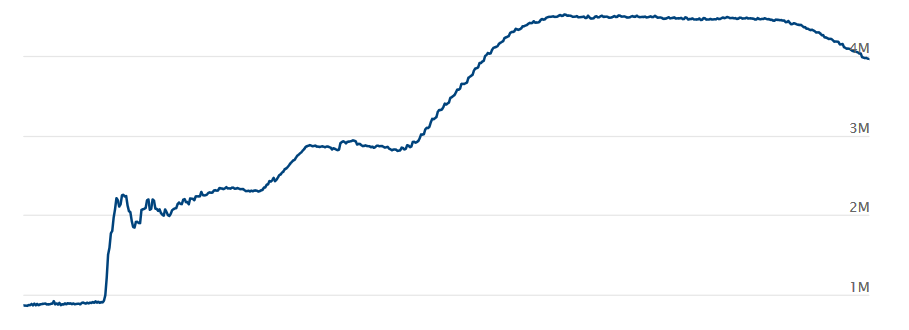

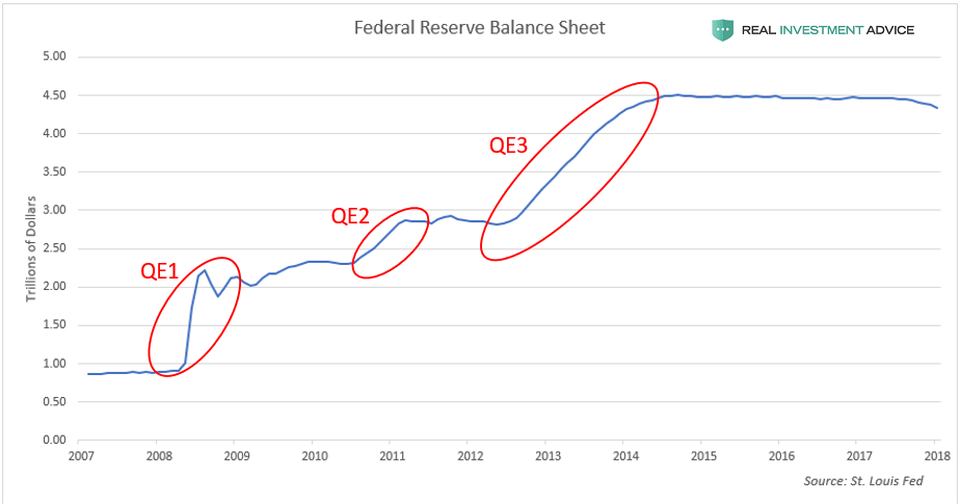

QE is an

extraordinary expansion of the open market operations of a central bank to create the “wealth effect”. It’s used to stimulate the economy by

making it easier for businesses to borrow money. The bank buys securities from its member banks

to add liquidity to capital markets.

This has the same effect as increasing the money supply. In return, the

central bank issues credit to the banks reserves to buy the securities.

Where do central

banks get the credit to purchase these assets? They simply create it out of

thin air. (Only central banks have this unique power.) This is what people

are referring to when they talk about the Fed “printing money.”

The purpose of this type of expansionary monetary policy is to lower interest rates and spur economic growth. Lower interest rates allow banks to make more loans. Bank loans stimulate demand by giving businesses money to expand. They give shoppers credit to purchase more goods and services. By increasing the money supply, QE keeps the value of the country's currency low. This makes the country's stocks more attractive to foreign investors. It also makes exports cheaper.

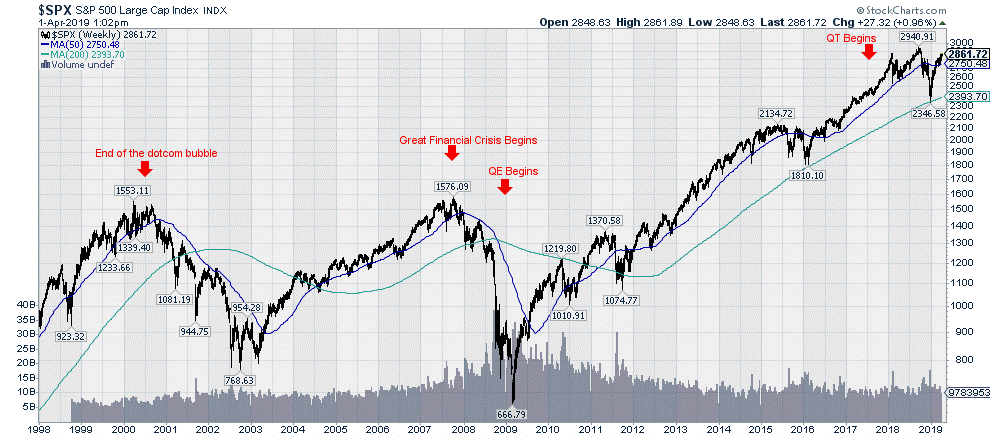

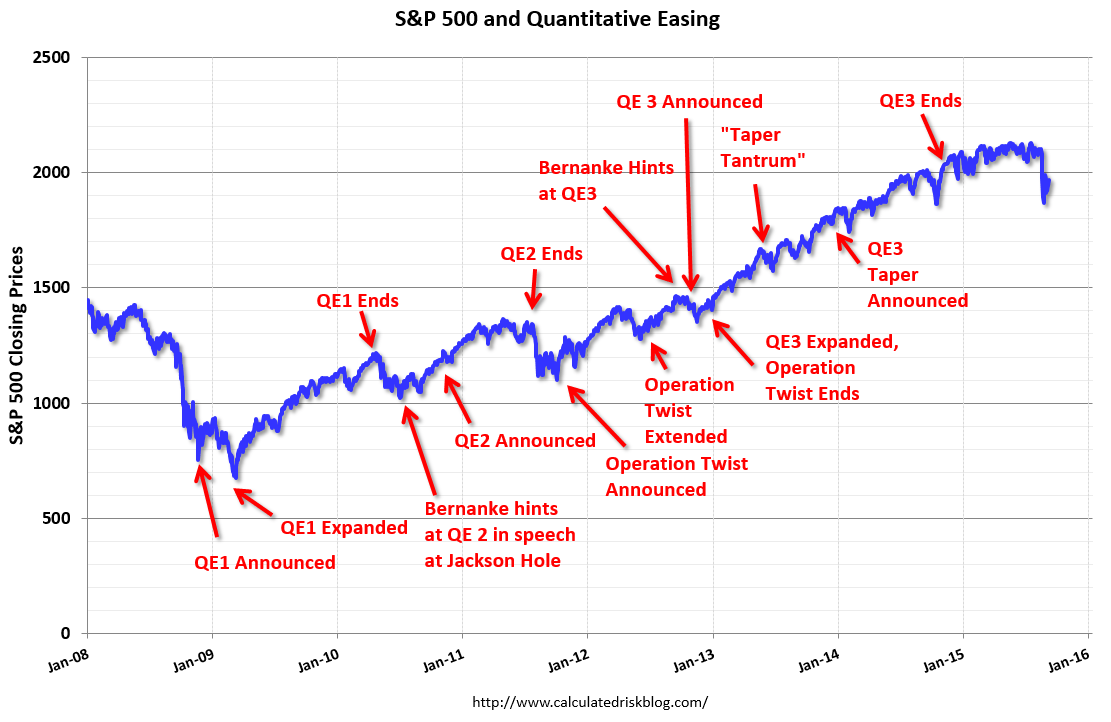

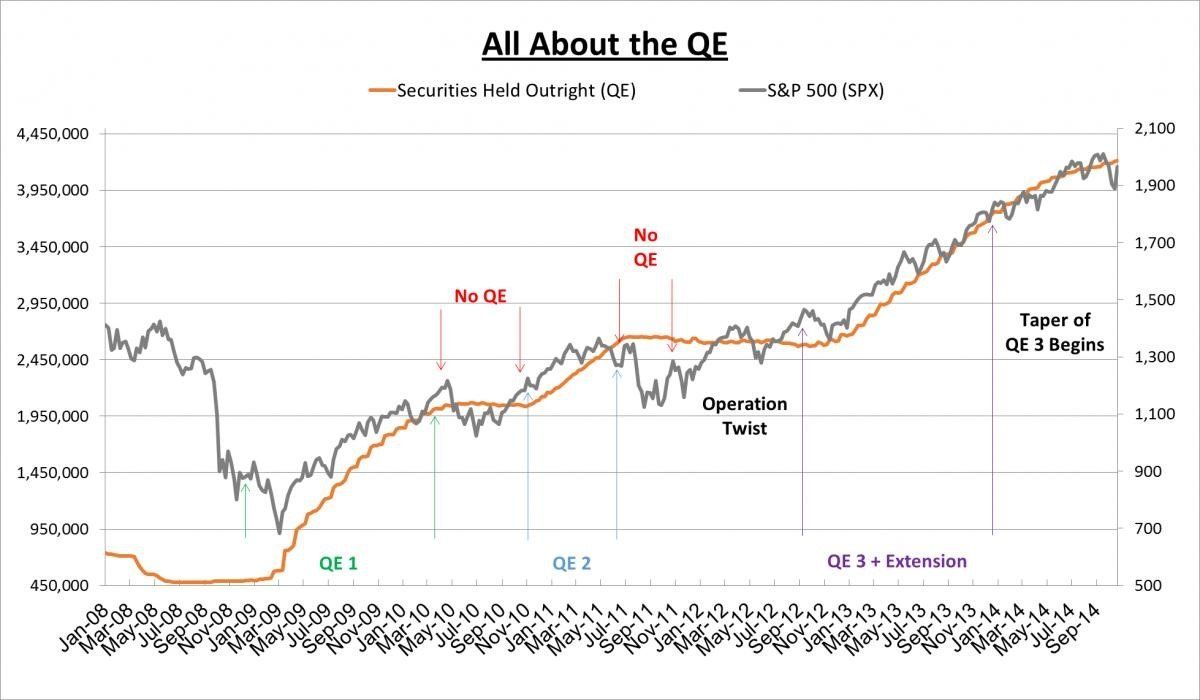

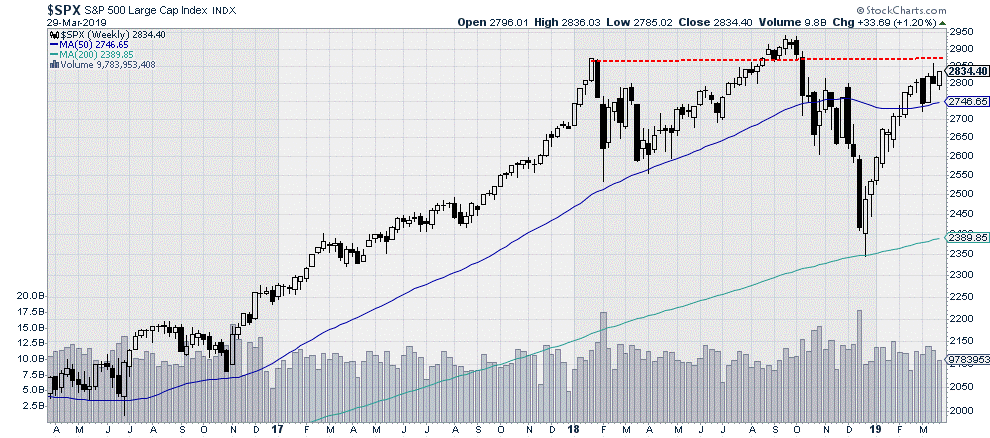

The stock market boom that began in 2009 would have been considered almost impossible based on prior history. And furthermore, for it to be accompanied by a real estate boom and a bond market boom that took the valuations of both to historical records at the same time is even less probable. It appears that this can only be explained by extremes in monetary policy that we have also never seen before. Those monetary measures must be unwound. So, the question becomes, how much of the stock, real estate and bond investment market boom will be unwound as unintended consequences? Common sense would imply that it would be very significant. And markets tend to overshoot on both ends of the scale.

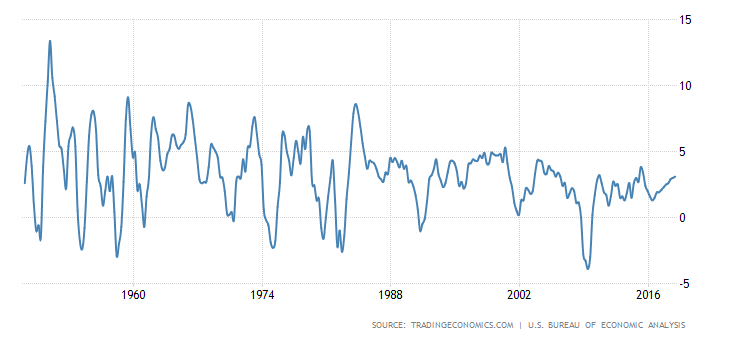

The stimulus failed to produce a stronger economy or Gross Domestic Product (GDP). GDP was much higher during prior recovery periods. The International Monetary Fund has recently been reducing its forecast for world growth in 2019. In October their estimate was 3.7%, in January it was 3.5% and the most recent was 3.3%. This, of course, includes China, the second largest economy, with a much higher growth rate. It appears the global economy is reliant on bubbles. Bubbles always burst.

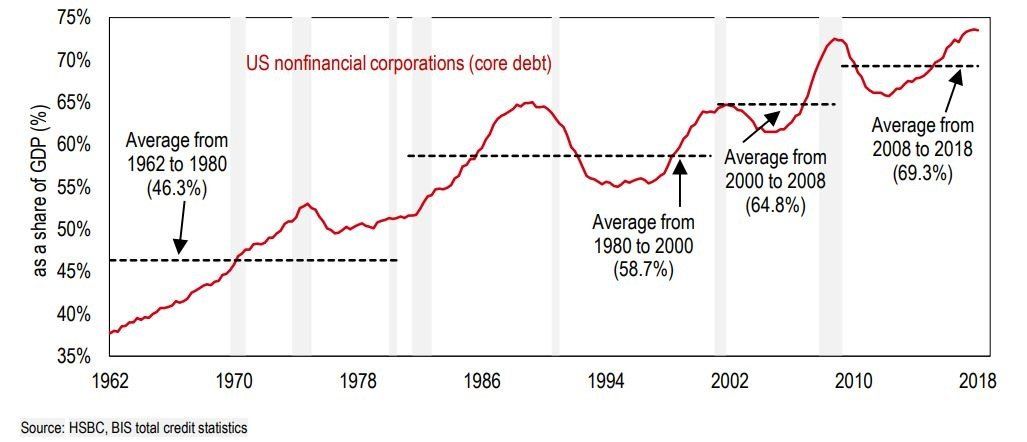

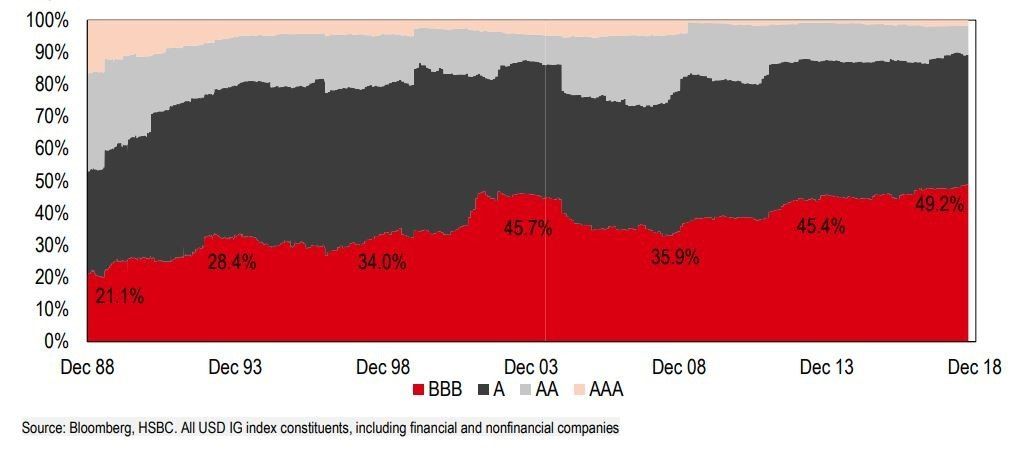

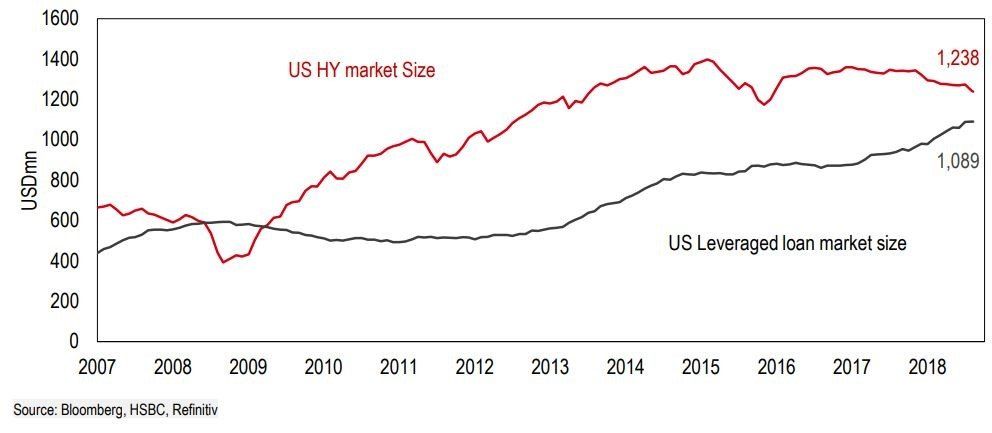

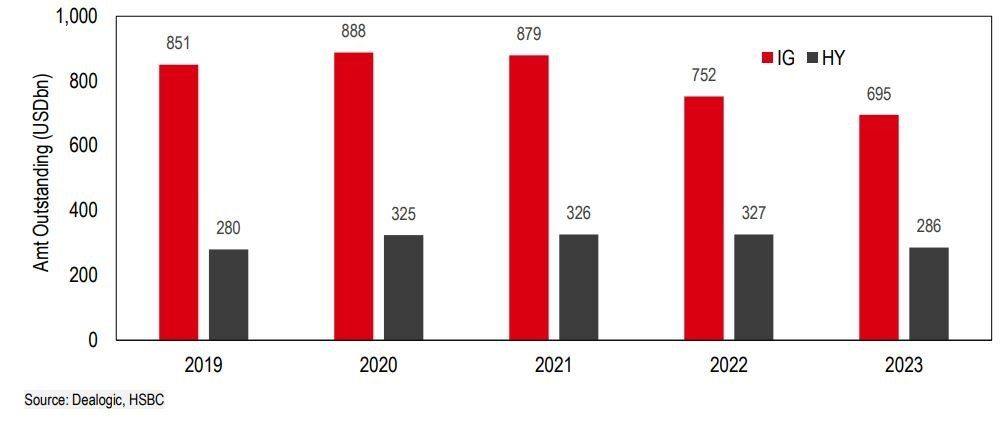

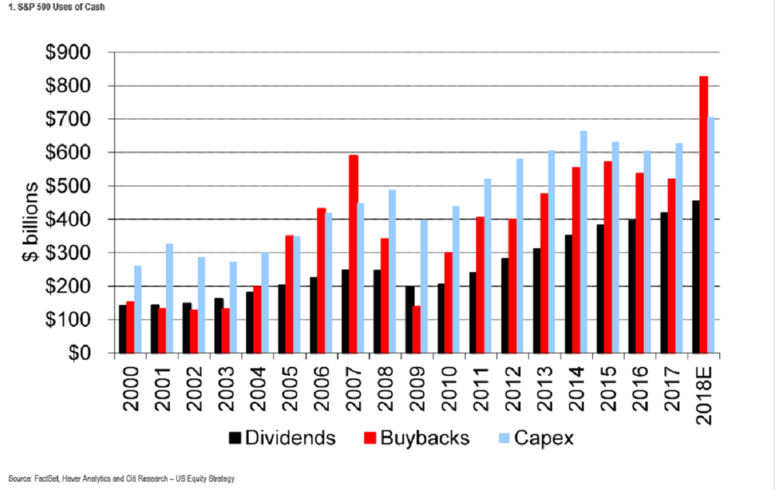

A mountain of corporate debt has resulted from the low interest rate policy. Companies have taken advantage of record-low interest rates to force up their balance sheets like they have never done before. Much of the capital raised this way has gone to fund stock buybacks, pushing equity valuations ever higher while leaving companies with dwindling assets to support their record liabilities.

"Price is what you pay; value is what you get." -Warren Buffett

|

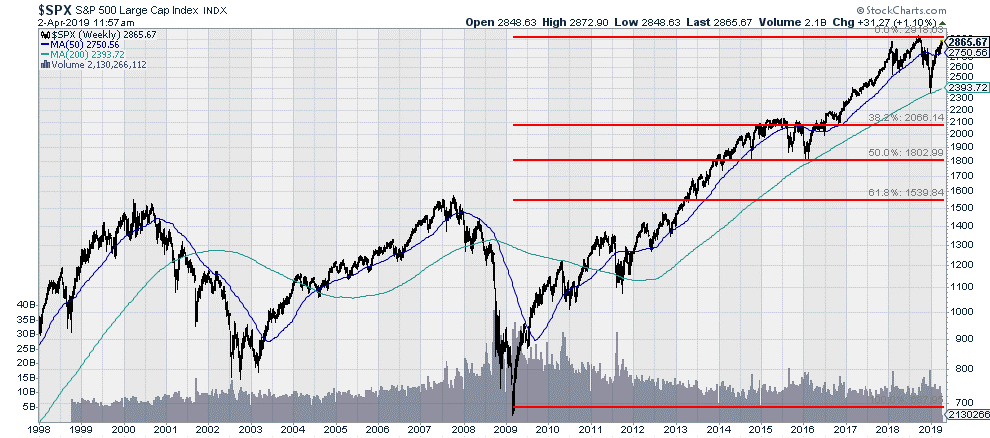

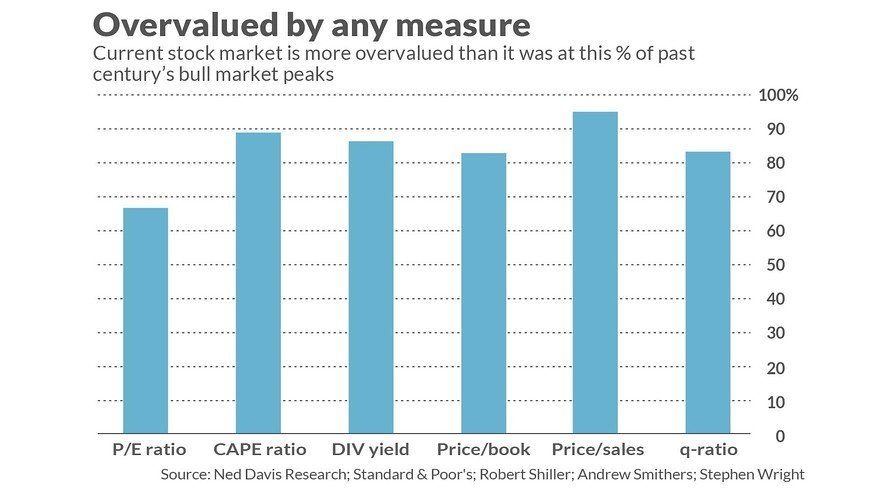

· The price/book ratio, which stands at 3.0 to 1. This ratio is higher than that at 22 of the 29 major market tops since 1929.

· The price/sales ratio, which stands at an estimated 1.9 to 1. At 18 of the 19 market tops since the mid-1950s, the price/sales ratio was lower.

· The dividend yield, which currently is 2.3% for the S&P 500. At 31 of the 36 bull-market peaks since 1900, the dividend yield was higher.

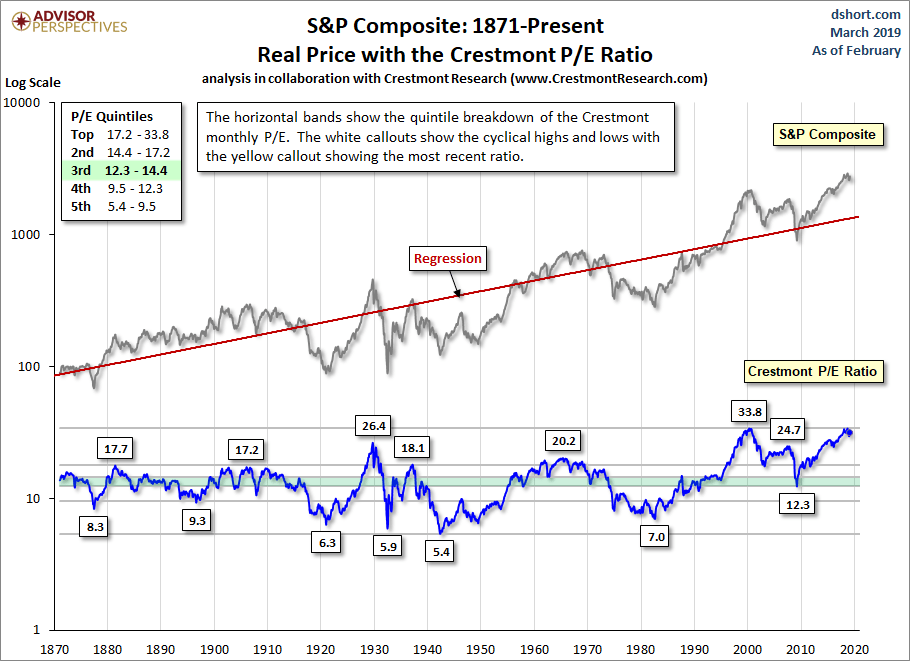

· The cyclically adjusted price/earnings ratio, which currently stands at 29.0. This is the ratio championed by Yale University’s Robert Shiller. It was lower than where it is today at 32 of the 36 bull-market highs since 1900.

· The so-called “Q” ratio, which is calculated by dividing market value by the replacement cost of assets. According Stephen Wright, an economics professor at the University of London, and Andrew Smithers, founder of the U.K.-based economics-consulting firm Smithers & Co., the Q-ratio currently is higher than it was at 30 of the 36 bull-market tops since 1900.

· P/E ratio. This is the valuation indicator that is currently painting the least-bearish (most bullish) picture. Perhaps not coincidentally, it is the indicator that is most often quoted in the financial press. Nevertheless, according to data on as-reported earnings compiled by Yale’s Shiller, and based on S&P estimates for the fourth quarter, this ratio currently stands at 18.4 to 1. That’s still higher than 67% of past bull-market peaks.

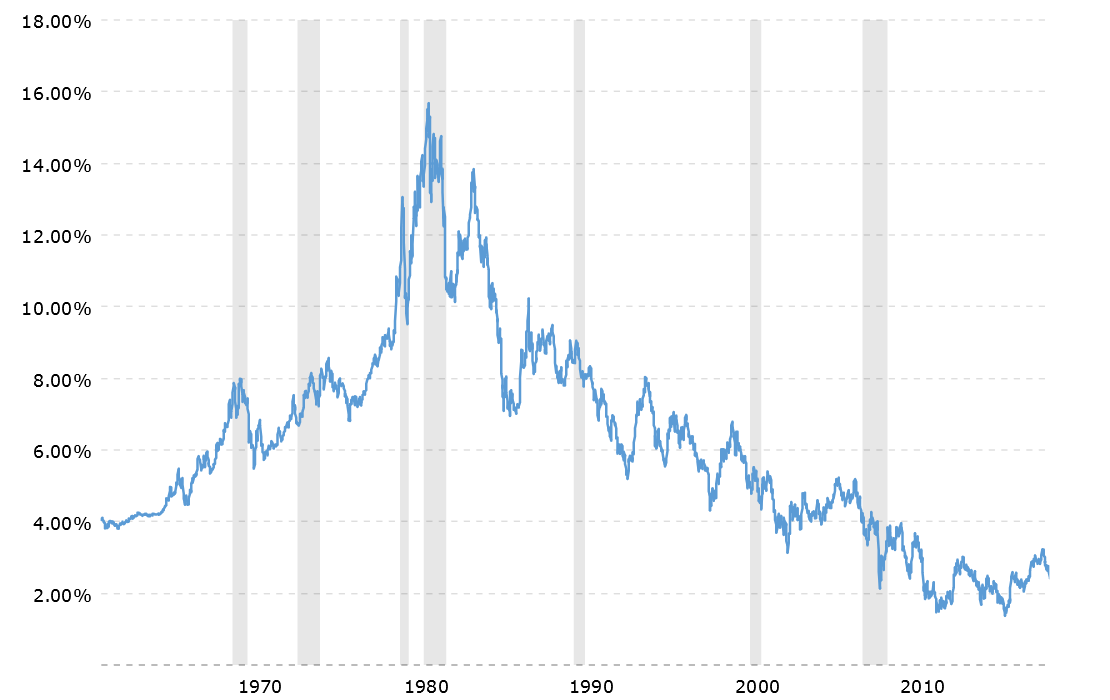

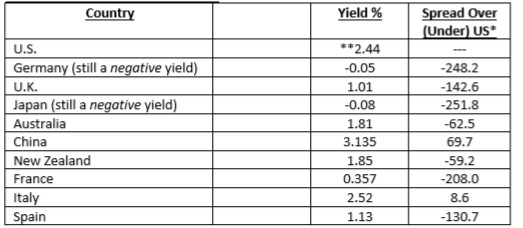

Bond values move in the opposite direction of yields. Therefore, the bond market valuation chart would be the reverse of the following chart of the 10-year bond yields. The stimulus has not only created a bubble in stocks, it has also created bubbles in bonds and other financial assets.

*in basis points

**the long-term average is approximately 5%, depending on the term

Summary

| This report is primarily based on research, analysis and charts that I purchase from investment professionals for whom I have a high regard. The reason I put this report together is to attempt to shed some light on the level of risk to which investors are exposed in the current investment environment. After ten years of extreme manipulation and stimulus, my observation as an advisor is that, for the most part, investors are not giving careful attention to the risk in relation to potential reward. In my opinion, extreme caution is advised. If I understand correctly, over $4 trillion of conjured-up money on the balance sheet of the U.S. Federal Reserve must be substantially eliminated. How and when this will be done and what unintended consequences will result are still unknowns—it has never been done before. And, if I understand correctly, after ten years of zero interest rate policy, target interest rates must be “normalized” globally. According to data from Deutsche Bank Securities, about $10 trillion of government bonds worldwide are priced to yield less than zero, which guarantee that a buyer will receive less in repayment and interest than the buyer paid for the bonds. This is not “normal”. I’m convinced that investment markets are due for a significant revaluation to the downside. No one knows when this will happen or how long the global central banks and governments can postpone it. No one knows what the catalyst will be that initiates the process, but it will surely be something totally unexpected. Index funds have performed well since 2009 and, as a result have grown tremendously in size. It seems reasonable that they are more heavily exposed to a significant downturn.

My goal is to be readily prepared and attempt to earn a decent return while significantly limiting exposure to the probable downturn. When crisis occur, opportunities arise for those who are prepared. Being cautious and flexible is advisable for anyone who is invested in risky assets—especially those who are retired or near retirement age. Financial advisors are fond of say things like, “we are long term investors, the market will come back after a downturn—it always does”. But sometimes it takes 20 years or more for a “comeback” to happen, and it is worse when inflation is included in the computation.

Thank you for reading. Any comments or criticisms would be appreciated.

Best regards in your efforts to maintain a comfortable standard of living, especially during retirement.

At your service to the praise of His glory,

Gary Clark |

|

|